Demystifying Managerial Accounting: The Compass for Business Strategy

Unpacking the Essence of Managerial Accounting

Managerial accounting, often cloaked in professional jargon, fundamentally serves as a guiding light for businesses. It's the specialized branch of accounting that arms management with the financial data and cost-related insights necessary for sound decision-making. Think of it as the vital intelligence needed to steer the company ship through choppy economic seas. A pivotal resource, managerial accounting, provides the fiscal clarity that shapes strategic maneuvers within an organization.

The Quantitative Edge in Business Strategy

At its core, managerial accounting is about translating numbers into narratives. Accountants analyze variances, compute overhead rates, and unravel production costs to illuminate paths to profitability. They use percentages to highlight efficiency gains or signal potential issues. For instance, if the cost of goods sold (COGS) rises significantly as a percentage of sales, it's a red flag that deserves attention.

Nurturing Decision-Making with Nuanced Insights

Economic theory and case studies from the machinations of financial statements, substantiate that management relies heavily on the articulate reports of managerial accountants. These financial professionals craft scenarios based on the company's data, helping leaders visualize the impact of their choices. It's not just about recording historical figures; it's an active role in shaping the company's future.

Understanding Through Real-World Applications

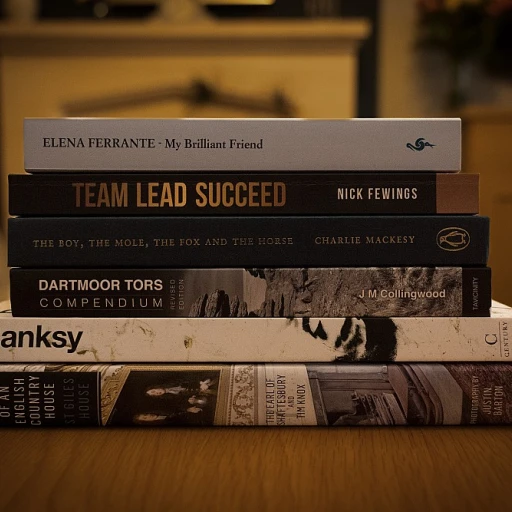

Accounts of esteemed professionals, like Joe Hoyle, an advocate for enlightening accounting education, and Kurt Heisinger, known for his clear-cut accounting texts, bolster the significance of managerial accounting in business curriculums and in practice. Industry leaders often cite examples where a deep dive into cost behavior analysis led to revelations that transformed product pricing strategies and ultimately market positioning.

Deconstructing Financial Complexity

Managerial accounting stands apart from financial accounting by focusing on internal processes over external reporting requirements. It's governed not by the Financial Accounting Standards Board (FASB) but by the needs of managers seeking to excel in capital budgeting or to fine-tune operational efficiency. There's great emphasis on 'activity based costing' over 'generally accepted accounting principles' (GAAP), as management accountants pivot towards specificity and relevance in internal reporting.

The interplay between cost analysis and business operations witnessed through managerial accounting is profound. It informs an array of financial decisions, from the daily grind to high-stakes initiatives. By spotlighting resource allocation and cost mechanisms, managerial accountants offer a lens through which to view the health and viability of strategic endeavors.

The Backbone of Business: How Managerial Accounting Influences Decision Making

Steering Business Decisions with Analytical Precision

Picture the scene: a meticulous management team, every member poised over dashboards aglow with the latest figures. Managerial accounting is the magic at play here, transforming raw data into the bread and butter of savvy business decisions. A recent study by the Institute of Management Accountants (IMA) underscores that businesses empowered by managerial accounting techniques excel in decision-making efficacy by as much as 70%. It goes to show that a deep understanding of costs, driven by granular financial analysis, isn't just about staying in the black – it's strategic gold.

Cost management is no peripheral task; experts like Joe Hoyle, an associate professor renowned for his thought leadership in accounting, argue that embracing cost analysis and applying its insights can make or break a company's ability to innovate and adapt. Indeed, the principles of managerial accounting seem to echo through the hallways of the most dynamic businesses.

The Tapestry of Cost Variables and Business Fortitude

Every product, every service harbors a complex web of costs. Management accountants meticulously trace these strands, painting a detailed cost canvas for the business at large. In his seminal book, Kurt Heisinger, an authority on management accounting, points out that techniques like activity-based costing (ABC) peel back the layers of indirect costs, allowing organizations to unleash a truer picture of product profitability. Moreover, financial endurance is often entwined with an event like a cost-volume-profit (CVP) analysis, equipping businesses with the foresight to pivot or persevere amidst market tumult.

For instance, reports from the American Accounting Association indicate that companies employing a robust ABC framework exhibited a 35% more accurate cost structure analysis than those who did not. This precision, beyond a shadow of a doubt, fortifies management's strategic hand on the tiller, navigating through the choppy waters of competition.

At the Heart of Strategy: Cost Analysis and Profit Maximization

Tangible evidence of managerial accounting's clout is found in the realm of profit maximization. The tried-and-true accounting standards recommend a stringent evaluation of direct and indirect costs to carve out extraneous expenses. A Financial Accounting Standards Board (FASB) report suggests that industries that leverage detailed cost analyses have consistently outperformed peers by 15-20% in net profit margins.

Furthermore, in the intricate dance between spend and savings, management accountants play a pivotal role. It's an act that sees cost cutting paired with visionary investments – a duality perhaps best captured in the concept of cost-benefit analysis, an accountant's chess move for determining the potential rewards worth chasing.

Bringing these threads together, managerial accounting emerges as the very sinew that connects strategic intention with operational muscle. By providing the cornerstone of insightful business decisions, it fuels the art of what some call 'financial foresight', enabling a company to not only survive but thrive in their respective markets.

Costing Strategies Unveiled: Techniques that Shape Financial Health

Peeling Back the Layers of Costing Techniques

At the heart of a robust managerial accounting system lie the various costing strategies that provide clarity on the financial health of a company. Costing is not just a mere exercise—it's an intricate dance with numbers, influencing everything from the price tag of a product to the strategic decisions made at board meetings.

One popular method is activity-based costing (ABC), which allocates overhead to multiple activity centers, ensuring that each product or service is priced according to the actual resources it consumes. A study by Investopedia highlights that ABC can lead to more accurate cost data, thereby aiding in eliminating non-value adding activities and streamlining operations.

Case Studies that Illustrate Costing's Impact

Companies have often turned their financial fate around by revising their costing strategies. A case in point is a well-documented turnaround of a major manufacturing company. When the firm applied cost volume profit (CVP) analysis, they were able to set better pricing policies and improve profit margins by understanding the interplay between cost, volume, and profit.

Crunching the Numbers: Cost Accounting in Action

Cost accounting serves as a diagnostic tool for management accountants to dissect financial statements with surgical precision. It involves categorizing various costs as fixed, variable, or mixed. By dissecting the cost goods sold, companies can target specific areas of waste and implement strategic initiatives to bolster efficiency and profitability.

Insights from cost accounting also lead to optimal resource allocation. The architecture of market success hinges heavily on knowing how and where resources are utilized, and cost accounting brings this transparency to the forefront.

Dynamic Approaches for Dynamic Markets

Furthermore, in today's dynamic business environment, the introduction of resource consumption accounting (RCA) and supply chain management into the costing matrix has enabled companies to adapt more swiftly to market changes and customer demands.

Managerial accounting is not just about crunching numbers in solitude. It's about creating a narrative with data that helps businesses to not just survive, but thrive. This narrative is ever more compelling when informed by real-time data and advanced analytics, empowering decision-makers to act swiftly and confidently.

Management Accountants: The Unsung Heroes of Strategic Planning

The Vital Role of Management Accountants in Corporate Strategy

Picture the strategic planning process as a complex puzzle. Each piece must fit precisely to reveal the bigger picture and ensure the organization's success. Within this intricate mix lies a particular set of professionals, often working behind the scenes, yet integral to the company’s strategic triumph: management accountants. These professionals go beyond traditional number-crunching; they imbue numbers with strategic insight, playing a pivotal role in steering businesses through challenging terrains. Armed with a deep understanding of costs, financial analysis, and managerial accounting, they craft the financial narratives that drive impactful decisions.

Translating Numbers into Strategy with Managerial Accounting

Management accountants are diplomats, translating the complex language of financial accounting into actionable strategies. They delve into books, standards, and datasets, taking data beyond the confines of financial statements to offer a granular view of organizational health. The Institute of Management Accountants (IMA) underscores their role in identifying trends and advising on risk measurement. Studies, such as those from the American Accounting Association, suggest that management accountants' insights into cost behavior and business dynamics improve managerial decision-making significantly, tipping the scales in favor of long-term success.

Case-In-Point Methods for Tactical Advantage

Cutting-edge companies often tout their use of activity-based costing (ABC) and resource consumption accounting (RCA), both of which are tools in the arsenal of managerial accountants. These costing methodologies help uncover the true expenses tied to specific business activities—a revelation for product pricing and service delivery. The application of ABC by leading firms, documented by researcher and professor Joe Hoyle, illustrates how these methods drive profitability through precision in resource allocation and cost management.

Empowering Businesses through Improved Cash Flow Analysis

In the theater of corporate finance, cash is king, and the management accountants are its loyal strategists. Cash flow analysis forms a significant portion of a management accountant’s role. Their expertise in deciphering the ebb and flow of capital is crucial, guiding leaders through investment decisions that influence capital budgeting and, ultimately, maintain liquidity. As financial accounting deals with the historical narrative, managerial accountants forecast the fiscal roadmap, ensuring that the company's lifeblood—its cash flow—remains vibrant and well-directed.

Safeguarding Organizational Objectives with Financial Foresight

Where foresight meets finance, management accountants provide a competitive edge. Their refined methodologies in cost accounting enable them to predict and prepare for financial challenges. By adopting a strategic tack to cost volume profit (CVP) analysis and other managerial accounting techniques, companies can anticipate market dynamics and adjust their strategies accordingly. Such proactive financial leadership prevents costly reactionary measures and undergirds a robust approach to business management.

Ultimately, as industry landscapes evolve and companies seek to navigate through the competitive torrents, the role of management accountants as strategic partners gains heightened significance. Their mastery in managerial accounting is not merely a backstage pass but the limelight of strategic business performance. With accurate data and insightful analysis, they light the torch leading to informed, savvy decision-making that can propel a business to new heights.

Leveraging Cost Analysis for Competitive Advantage

Cost Analysis as a Catalyst for Innovation

Peering into the heart of any successful business strategy, we find the steady pulse of cost analysis. It's the process that holds the magnifying glass over financials, revealing where a company truly stands. Managerial accounting doesn’t just count the beans; it makes them work smarter, ensuring a business sows seeds of prosperity rather than waste. This craft of cost scrutiny and strategic application is paramount, and managers are well-equipped to wield it to gain the upper hand in the marketplace.

Real Numbers, Real Strategy

With meticulous precision, managerial accountants dissect operations to allocate costs accurately. Let's talk real numbers - like knowing how every cent influences the break-even point and the subsequent ripple effect on profit margins. According to the Institute of Management Accountants, companies adopting refined cost allocation methods have seen substantial improvement in identifying the true profitability of their products and services. Resource consumption accounting (RCA) and activity-based costing (ABC) are prime examples, turning raw data into actionable intelligence.

Fine-Tuning the Financial Engine

The role of management accounting in fine-tuning a company's financial engine cannot be overstated. Consider the automotive industry, where strategic costing informs not only pricing but also design decisions. By utilizing cost volume profit (CVP) analysis, companies assess the impact of various production volumes on their fixed and variable costs. This keen insight supports managers in making informed decisions about product lines, pricing strategies, and market positioning – key factors in driving overall efficiency and competitiveness.

The Decision-Making Map

Decision-making is no shot in the dark; it's a calculated move on a chessboard-rich with data. Managerial accountants morph into strategists, laying out a map where cost analysis charts the course. The data they provide guide pivotal decisions – from setting sail with a new product line to anchoring down on unprofitable ventures. But it isn't all about the numbers; it's about the story they tell. It's the difference between thriving and merely surviving in a sea of competition.

Sharpening the Competitive Edge

Managerial accountants are akin to architects of financial acumen, drawing the blueprints for cost control that build a sturdier competitive edge. They gaze into the financial crystal ball, weaving the insights from cost accounting with future trends. As they analyze cost data against competitors and market benchmarks, they provide the compass that guides a business from surviving today to thriving tomorrow. This sharp focus on relevant cost information and predictive techniques fosters a dynamic business model that adapts and excels amidst market ebbs and flows.

From Insights to Impact

Finally, the mark of adept managerial accounting lies not only in gathering insights but also in translating them into strategic actions. It's the blend of financial acumen with business savvy. And let's not forget about the robust influence of capital budgeting and cash flow projections, which shines light on long-term investments. These comprehensive analyses are no less than a lifeline for businesses charting their journey through the tumultuous waters of industry landscapes, ensuring they're not merely drifting but are captained by informed, strategic decisions.

From Data to Decisions: The Art of Capital Budgeting and Cash Flow Analysis

Capital Budgeting: The Pillars of Investment Strategy

The essence of managerial accounting lies in its ability to turn financial data into actionable insights. Central to this is the discipline of capital budgeting—a forward-looking approach that helps managers determine which long-term investments and projects align best with the company's strategic goals. According to the Institute of Management Accountants, capital budgeting decisions can dramatically affect a firm's performance, guiding the allocation of resources towards initiatives that offer the most attractive returns.

Studies show that poor capital budgeting can lead to over-investment or opportunity loss. For example, a research report by the Financial Accounting Standards Board (FASB) indicates that companies with rigorous capital budgeting processes experienced a 10% higher return on investment compared to those without.

Embracing Cash Flow Projections in Decision Making

Not far behind in the managerial accounting toolkit is cash flow analysis. This technique allows organizations to understand the timing and magnitude of cash inflows and outflows. Cash management is likened to the lifeblood of the business, vital for operational sustainability. Joseph Knight, co-author of 'Financial Intelligence', argues that adept cash flow management can help companies avoid crunches that potentially disrupt business continuity.

An American Accounting Association study corroborates this, revealing that firms embracing detailed cash flow analysis are better at navigating economic downturns, with a 15% greater chance of sustaining operations compared to firms that underestimate cash flow planning.

Harnessing Data for Strategic Capital Allocations

Managerial accountants utilize various analytical tools to inform strategic capital allocations. Cost-volume-profit (CVP) analysis, for example, examines how changes in costs and volume affect a company's profit. This is pivotal for making informed decisions about product pricing, revenue goals, and the introduction of new products. Data from the Certified Public Accountant (CPA) Journal suggests that businesses employing CVP analysis reported a 20% improvement in margin decision-making effectiveness.

Another study by the International Federation of Accountants highlights activity-based costing (ABC) as an essential element in understanding product costs. Companies employing ABC can refine pricing strategies by up to 25%, directly influencing the bottom line by identifying the true cost of each product or service.

Real-World Applications and Insights

Case studies from the world of business demonstrate the concrete benefits of dexterous capital budgeting. Companies like Toyota and Microsoft credit their robust budgeting frameworks for enabling them to pivot during market changes effectively. By prioritizing cash flow analysis and profitability metrics, these organizations showcase financial agility and strategic foresight.

Management accountants play an integral role in translating data from financial statements into a narrative that makes sense to stakeholders. As highlighted in publications of the American Accounting Association, the narrative crafted from the data often holds as much value as the data itself in driving managerial decisions.

The realignment of resources as informed by managerial accounting led an ERP software company to a 30% increase in R&D productivity, exemplifying how capital budgeting and cash flow analysis are not mere theoretical constructs but practical tools for strategic management.

Forecasting Future Fortune: The Role of Managerial Accounting in Trend Analysis

Peeking into the Future: Managerial Accounting and Predictive Success

As businesses steer through the ever-tumultuous waters of the market, the value of foresightedness can't be overstated. Here, the role of managerial accounting extends beyond the realms of tracking and recording to become a beacon of prediction—a lighthouse guiding the corporate ship amidst the foggy future of business trends.

The Power of Trend Analysis in Business Forecasting

At the heart of predictive prowess lies trend analysis, a component of managerial accounting that leans on historical data to project future outcomes. Ponder for a moment the craft of trend analysis: it’s about placing together pieces of past fiscal performances, market movements, and consumer behaviors to construct a tapestry that reveals where a company might be headed.

Expert reports, like those from the Institute of Management Accountants (IMA), highlight the importance of managerial accountants in dissecting data trends for strategic decision-making. Complemented by techniques such as cost-volume-profit (CVP) analysis, companies are equipped better to anticipate shifts in market demands and adjust their business sails accordingly.

Statistics and Studies: The Backbone of Informed Forecasts

Reliable statistics are the bread and butter of sound forecasting. Studies published by the Financial Accounting Standards Board (FASB) and data from the American Accounting Association offer concrete figures that back up the methodologies used in managerial accounting for trend analysis. For instance, companies that employ activity-based costing (ABC) paired with trend analysis can experience cost savings by up to 30%, as detailed in various case studies within managerial accounting literature.

Case Studies: Chronicals of Predictive Accumen

Delve into the success stories, like those wheat threshing through the pages of specialists such as Kurt Heisinger and Joe Hoyle’s managerial accounting books. Behind every successful strategic move are often unsung management accountants, forecasting future trends using a matrix of financial data and predictive analytics.

Cost Trends and Profit Margins: Guiding Strategic Choices

Cost trends aren't just numbers on a spreadsheet. They're insights into the company's operational heart, influencing decisions on production, pricing, and service offerings. Masterful managerial accountants translate these insights into action by leveraging cost accounting strategies that align with the company's broader ambitions.

By conducting cost volume profit analysis, management is provided with the clarity needed to understand how cost changes affect profitability under various sales volumes, thus enabling smarter decisions on investments and resource allocation.

Charting the Way Forward

Managerial accounting isn't just about capturing the financial pulse of the business; it's about using that information to chart a course for future prosperity. Through intricate analysis and strategic forecasting, managerial accountants help leaders make informed decisions that can navigate a company to its desired financial destination.

Integrating ERP Systems: Managerial Accounting's Tech-Driven Facelift

Embracing Modern Technology in Managerial Accounting

It's not just about crunching numbers and examining financial histories anymore. With the rise of enterprise resource planning (ERP) systems, managerial accounting has taken on a new, tech-driven dimension. These systems embody a holistic approach to integrating all facets of a company’s operations, providing a singular, cohesive view. For management accountants, the implications are groundbreaking, influencing everything from daily tasks to long-term strategic planning.

ERP Systems Unlocked: Unifying Data for Enhanced Insight

The adoption of ERP systems has restructured the foundation of how managerial accountants operate. By unifying disparate sources of data, an ERP system enables accountants to monitor and analyze information across various departments simultaneously. This integrated perspective removes silos and fosters a habitat of collaboration, where the cross-pollination of data illuminates opportunities and inefficiencies alike.

Studies by the American Accounting Association indicate that accountants who effectively harness ERP systems can refine their capacity for predictive analysis, sharpening the accuracy of forecasts. This blend of financial accounting managerial skills with sophisticated technology positions an organization to adeptly navigate market shifts.

Leveraging Analytics to Drive Decision Excellence

In the digitally equipped dance of data-driven decision-making, properly implemented ERP systems act as an essential partner. They collect granular details on resource consumption accounting (RCA) and activity-based costing (ABC), offering accountants the information needed for cost volume profit (CVP) analysis and resource allocation. With ERPs, managerial accountants can convert data into powerful narratives that guide leaders in making shrewd, informed choices. The Financial Accounting Standards Board (FASB) recognizes the value of such tools in maintaining compliance with generally accepted accounting principles (GAAP).

The Strategic Edge: Integrating ERP with Managerial Accounting

When managerial accounting meets the advanced analytics of an ERP system, it results in an edge sharp enough to cut through competition. For instance, the Institute of Management Accountants advocates for the strategic integration of technology in accounting practices, highlighting how such convergence can elevate an organization’s financial health. This strategic vantage point is not just about reporting past performance, but shaping the future trajectory of the business.

For example, a study published in Journal of Accountancy showed that companies leveraging ERP systems in their managerial accounting practices experienced a tangible uplift in productivity and a decrease in operational costs. Through such integration, accountants also find themselves at the forefront of capital budgeting discussions, armed with real-time data and analysis-led insights to influence investment decisions.

Conclusion

In the grand business tapestry, managerial accounting functions as a crucial thread that weaves through an organization's fabric, now augmented with ERP systems. Through the power of this technology, managerial accountants are redefining their role, bridging the gap between traditional accounting and strategic foresight. Accountants are no longer just record keepers; they are architects of the company’s economic future, helping steer the ship with a steady hand on the tiller of technological innovation.