Understanding the Importance of an Entrepreneurial Exit Strategy

The Cornerstone of a Sustainable Business

As an entrepreneurial journey unfolds, one aspect that consistently holds sway over long-term success is the integration of a solid exit strategy into the business plan. Dismounting the entrepreneurial ride with grace, and most importantly, profit, requires a prudent and calculated approach. According to the Exit Planning Institute, an astonishing 50% of business exits are involuntary, spurred by critical circumstances like health issues, burnout, or divorce. This statistic magnifies the necessity for a planned approach to exiting.

Expert Opinions Echo the Sentiments

Leading business minds affirm that a coherent exit strategy—as much as the entry strategy—is a testament to wise management. Successful practitioners, like esteemed business author John Warrillow, suggest that starting with the end in mind ensures a structured pathway for growth. His work, 'Built to Sell: Creating a Business That Can Thrive Without You', emphasizes the importance of constructing a business that is attractive to potential buyers from the outset.

Financial Modeling: A Numerical Contract With the Future

Financial modeling stands as a pivotal element in exit planning, painting a quantitative picture of the business’s trajectory. The Chartered Financial Analyst (CFA) Institute underscores the relevance of robust financial models as tools to predict cash flows, which in turn weigh heavily on business valuation during the exit phase. A finely tuned model acts as a beacon for potential buyers, signifying business health and future profitability.

A Strategy Stitched in Time

Timing is, without question, the sinew that holds the exit strategy together, with market trends serving as the tapestry. A Harvard Business School report illuminates how the timing of an exit can significantly impact the final sale price. Properly anticipating economic fluctuations and industry developments can be the very leverage that enhances an exit's financial outcome.

When Every Detail Counts

The complexities of exit strategies weave into every facet of the business fabric. Comprehensive planning involves not just when to exit, but how. Whether it is a management buy-out (MBO), initial public offering (IPO), or acquisition, each pathway has unique considerations. As Certified Mergers & Acquisition Advisor (CM&AA) credentials gain traction, the expertise in crafting bespoke exit nuances grows.

The Right Timing for Your Exit: Aligning Strategy with Market Trends

Syncing Your Watches: Optimal Timing Meets Market Dynamics

As a seasoned entrepreneur, recognizing when to initiate your business exit can be as critical as the exit itself. A well-calibrated departure aligns with both personal goals and external economic tides. Take for instance, the recent study by Exit Planning Institute, highlighting that nearly 50% of exits are involuntary, spurred by external factors such as market downturns or health issues. Timing your exit during a market upswing can significantly amplify financial returns.

It's intriguing to witness the transformation a robust exit plan can introduce. For instance, amidst growing market consolidations, a strategically timed exit can catapult a business owner to new heights of financial success. Such precise timing often involves intense market analysis, sometimes aided by financial modeling guidelines CFI endorses, ensuring a lucrative leap towards future endeavors.

Anecdotal evidence from BDC suggests that the best exits are those where owners have leveraged growth upturns or industry trends. The timing doesn't just revolve around the market but also a company's performance peak. Striking while the iron is hot could mean riding the wave of a recent success or a groundbreaking product launch, thereby stirring the interest of potential buyers or investors.

Consider the case of tech start-ups; timing often aligns with significant milestones in innovation or user acquisition. Driven business owners can observe the fintech industry, where timing exit strategies around technological breakthroughs can prove to be lucrative. On the flip side, lingering too long could mean getting caught in the midst of a bursting bubble, as noted in a report by CMSA.

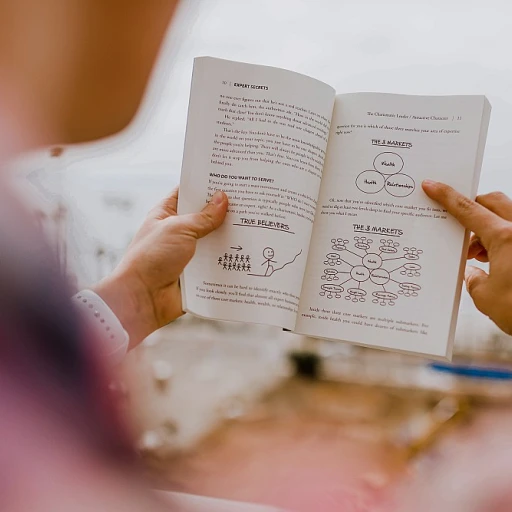

Deep analysis and financial modeling not only aid in identifying the prime moment for initiating an exit, but they also cater to potential buyers' expectations. A sound exit strategy considers the investment business cycle, aiming for a phase of heightened investor interest. For a unique peek into this realm, a trip into the pages of 'Financial Modeling & Valuation,' penned by industry mavens, can be illuminating.

In the end, an entrepreneur's strategic approach to accounting for future growth will weave into their exit time. It is the delicate dance of maximizing value while remaining nimble enough to respond to the pulse of the market and personal aspirations.

Comprehensive Exit Planning: Financial Modeling and Valuation Essentials

Building a Solid Foundation with Financial Modeling

Stepping into the world of entrepreneurial exits, one cannot overstate the importance of rigorous financial modeling and valuation. This is the framework that not only paints a picture of a company's financial health but also showcases its potential to prospective buyers or investors. A meticulous financial model serves as a critical tool for business owners to strategize their exit plan, ensuring a clear understanding of the company's worth and the levers affecting its value.

Valuation Essentials: More Than Just Numbers

To a potential buyer or investor, the numbers need to tell a compelling story, one replete with past triumphs and the promise of future gains. Harnessing the power of data management can significantly aid in financial modeling, ensuring that each figure is rooted in verifiable facts. Valuation is both an art and a science, with various methodologies ranging from Discounted Cash Flows (DCF) to comparables within the industry, providing a comprehensive view and a credible point for negotiations.

Integrating Exit Strategy with Financial Planning

When the art of valuation meets the strategic planning of an exit scenario, business owners engage in what is known as exit planning. This involves not just understanding their company's current financial standing but also planning scenarios involving sale, merger, or acquisition. It is crucial to foresee how different exit strategies can affect both the short-term and long-term financial projections of the business.

Case Studies: Learning from the Best

Real-life examples shine a light on successful exit strategies. Cases where businesses had a thoroughly planned exit showcase better financial returns. Whether it's an initial public offering (IPO) or a strategic sale, these case studies provide actionable insights and help underscore the importance of a well-crafted financial model in the exit planning process.

Maximizing Value for a Winning Exit

The end goal of exit planning is to maximize shareholder value. Therefore, financial modeling is not a static process but one that should account for various growth strategies and how these strategies would appeal to a spectrum of potential buyers or private equity investors. This includes presenting different scenarios in which the company thrives, supported by robust financial planning and strategic foresight.

Strategies to Attract Potential Buyers or Investors

Wooing the Market: How to Attract Potential Buyers or Investors

When you're considering a graceful exit from your business, understanding ways to draw in interested parties is half the battle. Just like preparing your home for an open house, prepping your company involves more than a fresh coat of paint; you need a robust strategy that emphasizes its value and potential. Let's chew over some battle-tested methods to entice those elusive potential buyers or investors.

A Winning First Impression: Business Sales Materials

Your business's sales materials are akin to a handshake: they need to be firm and impressive. You've got your comprehensive financials down pat, thanks to meticulous financial management strategies, but how about the sizzle that sells the steak? From asset lists and customer contracts to unique selling propositions, every document should scream 'buy-in opportunity.'

The Inside Scoop: Value Proposition

What gets investors' hearts racing is the promise of value. Yours could be an innovative product that's changing the game or a loyal customer base that’s ripe for expansion. If your business has a secret sauce—a proprietary technology or a market-leading process—make sure it's front and center. But don’t just tell, show. Back up your claims with data, case studies, and testimonials that prove you're not just another fish in the sea.

Story Time: Your Company Narrative

Every brand has a story, and yours needs to be Shakespearean. Well, maybe not that dramatic, but potent enough to connect emotionally with potential buyers. They should feel they're not just investing in a business, but becoming part of a legacy. Nail down your origin story, challenges surpassed, and visions for the future. Make it less of a transaction and more of a continuing saga.

Good Housekeeping: Business Health and Prospects

Potential buyers want to know they’re making a sound investment, so you’ve got to hand them a clean bill of business health, backed by a vibrant business plan. Have an exit strategy place that emphasizes growth and stability. Your operational systems, management team, and workforce should all look well-oiled and ready for smooth sailing under new ownership.

Networking Know-How: Leveraging Industry Connections

A little bird once said, 'It's not what you know, but who you know'—and when you're aiming to sell or attract investors for your business, truer words were never chirped. Deep dive into your contact list, schmooze at industry events, and engage in thought leadership. The right handshake at a networking event can lead to a transformational introduction.

The Power of the Teaser: Confidential Information Memorandum (CIM)

A CIM is your business's teaser trailer. It’s meant to intrigue and entice, revealing enough to whet the appetite without spilling all the beans. This document is often the first concrete piece of information a potential buyer will see, so make it count. Highlight strengths and opportunities while being open about challenges—buyers appreciate transparency and it can reinforce trust.

Exit Plan Structuring: MBOs, IPOs, and Acquisitions

Mapping Out Your Exit: MBOs, IPOs, and Strategic Acquisitions

Charting the course of your entrepreneurial journey requires a keen understanding of the most advantageous exit routes. Management buy-outs (MBOs), initial public offerings (IPOs), and strategic acquisitions each offer distinct advantages depending on your business objectives and industry landscape.

Management Buy-Outs: Keeping It in the Family

An MBO can often be a win-win scenario, allowing business owners to pass the reins to a management team familiar with the company intricacies. It is also seen as a less disruptive and more controllable exit strategy. According to the Exit Planning Institute, the success rate of MBOs can be greatly increased with proper planning and financial modeling. Comprehensive pre-exit planning ensures that the management team is well-prepared to take over, and the business continues to operate smoothly, sustaining its value post-exit.

Initial Public Offerings: Opening Doors to the Market

For those eyeing a grander scale, an IPO might be the best route. The decision to go public through an IPO involves meticulous planning and robust financial modeling. The allure of an IPO is undeniable, with potentially higher returns and increased market presence. A study from the Financial Modeling Valuation Analyst (FMVA) at Corporate Finance Institute (CFI) suggests that companies engaging in IPOs must be prepared for stringent regulatory scrutiny and the demands of public market investors.

Strategic Acquisitions: Aligning with Industry Titans

Strategically aligning with larger corporations through acquisitions can unlock significant value. For many business owners, this is an ideal path, offering a clear exit with financial gain while ensuring the business legacy continues under new leadership. A report by Business Development Canada (BDC) highlighted acquisitions as a popular strategy in fast-paced sectors where large companies are seeking innovation through acquiring smaller players.

Each exit pathway demands a bespoke strategy, taking into account the company's specific needs, industry trends, and financial health. While an MBO might appeal to those looking for continuity, an IPO is often more suited to businesses with a strong growth trajectory and the need for capital. Strategic acquisitions are favored when synergies and quick integration with a larger entity can be realized. In all cases, engaging with a Fintech industry professional or obtaining a CMSA (Certified M&A Specialist) accreditation can be beneficial in navigating the complexities of exit plan structuring.

Expert Insights Into Crafting Your Exit Blueprint

Dr. Emily Rogers, author of "Exit Planning Strategies: A Practical Guide", stresses the importance of a well-orchestrated exit plan, noting that 'the best exits are those that are as meticulously planned as the business strategies that led to the company's success.' Concurrently, financial advisors emphasize the role of financial modeling in projecting the outcomes of different exit scenarios. As per Financial Modeling Guidelines by CFI, precision in forecasting the company's financial future is vital for successfully managing an exit.

For a small business owner, exit planning might seem daunting, yet data underscores the positive impact of early and thorough exit strategies. A survey from the Exit Planning Institute shows that businesses with a detailed exit plan are 50% more likely to sell at a premium compared to those without one.

In the diverse spectrum of exit strategies, each business owner must gauge their company's position, consider the pros and cons of various exits, and tailor a unique plan that paves the way for not just a successful exit, but also a prosperous legacy.

Legal and Tax Considerations: Navigating Complex Regulations

Navigating Complex Regulations

When planning an entrepreneurial exit, the legal and tax considerations are much more than footnotes in your departure narrative. They hold the power to significantly harness or enhance the financial gains of your efforts. A common thread among business owners is the realization that early and insightful planning in these areas can lead to a smoother and more profitable transition.

IRS Guidelines and Tax Implications

The Internal Revenue Service (IRS) has a complex set of rules governing business sales, which can include capital gains tax, estate taxes, and sometimes even gift taxes. For example, in certain conditions, the sale of business assets can be classified as long-term capital gains, which are taxed at a lower rate than ordinary income. Being savvy with IRS guidelines can help an owner save a significant portion of their exit proceeds.

Legal Structures and Asset Protection

Legal structures, like C corporations, S corporations, LLCs, and partnerships, each have unique implications for how a business sale is executed and taxed. Engaging with a seasoned attorney to understand the nuances associated with your specific business structure is not just smart; it's a financially critical move.

Exit Planning Institute Insights

Experts at the Exit Planning Institute, armed with certification programs in exit strategy, underscore the importance of crafting a tax-efficient exit. They regularly spotlight how aligning your exit with the appropriate legal strategy could mean the difference between a good and a great financial outcome.

Exploring MBOs and Leveraged Buyouts

An MBO (Management Buyout) could serve as a practical route for some business owners. Here, the company's management team buys out the owner, a path often sealed with tax efficiencies if structured correctly. It's a technical ballet, requiring precise choreography between tax professionals and legal counselors.

Understanding Acquisition Agreements

Acquisition is another exit path regularly littered with legal caveats. The details buried in the fine print of acquisition agreements can shelter a business owner from future liabilities or unforeseen tax consequences. Consulting with a legal expert on the formulation of these agreements is akin to planting a robust oak tree today to enjoy the plentiful shade tomorrow.

The Impact of IPOs

For those considering an Initial Public Offering (IPO), this strategy carries its own unique set of regulatory prerequisites. From adhering to the U.S. Securities and Exchange Commission's stringent reporting requirements to understanding the nuances of structured query language (SQL) for financial modeling, every step towards the public market illuminates the myriad of tax considerations and legal hoops.

Customizing Your Financial Modeling Valuation

Nothing screams meticulous attention to detail like a customized financial model that accounts for every possible scenario in an exit plan. Crafting this model with an eye on tax implications and potential legal hurdles sets a business on a runway poised for a smooth takeoff.

The Role of Certification Programs and Advisors

Certification programs such as those offered by the BDC (Business Development Bank of Canada) or CMSA (Certified Management Strategic Advisor) could prove invaluable. Engaging with fintech industry professionals or acquiring a financial modeling guidelines credential from CFI (Corporate Finance Institute) can equip a business owner with the tools and knowledge to navigate the exit process proficiently.

With the right combination of legal insight, tax strategy, and financial modeling, the craft of exiting your business becomes less of an overwhelming tangle and more of a calculated, rewarding effort. It's about confirming that the legacy of hard work is preserved and celebrated appropriately. As the saying goes, failing to plan is planning to fail—none more so than when it comes to the fine print of your business's grand finale.

Preparing for the Exit: A Guide to Transition Management

Guiding Your Team Through the Winds of Change

Transition management is the compass that steers the business ship towards its new horizon, post-sale. It is a meticulous process involving clear communication, leadership, and forethought to maintain a positive trajectory through the changeover.

Establishing a Transition Framework

Whether a business owner is paving the way for new ownership, or shifting towards another venture, developing a robust framework is vital. This framework serves as the blueprint for change, detailing responsibilities, timelines, and strategies to ensure business continuity during and after the transition. Structuring this transition may involve aligning interim management roles with individuals equipped to handle the particulars of change.

Nurturing Leadership and Company Culture

Leadership is not just about steering the ship; it's about keeping the crew committed to the journey. Preparing the company's leaders and maintaining a vibrant culture are paramount. This involves fostering leaders who can support teams, answer queries, and guide them through the transitional period. A study by the Exit Planning Institute suggests that company culture heavily influences the success of transition, impacting employee retention, and overall business stability.

Aligning Operations with the Buyer's Vision

Transitioning operations to fit the strategic aims of potential buyers is an exercise in adaptability. It means tweaking processes, re-evaluating management plans, and even revamping product strategies to make the business more attractive. These adjustments don't just sweeten the deal; they can also be a boon for a company's market position and long-term resilience.

Preparing for Contingencies

No transition is without its bumps. Therefore, planning for contingencies through robust financial modeling is essential. Owners must consider potential scenarios that could arise and model their financial impact. Not only does this planning minimize surprises, but it also reassures investors that the company is poised for smooth sailing under any conditions.

Succession Planning with Precision

For many small business owners, transition means succession. Crafting a detailed succession plan ensures that new leaders or owners are fully immersed in the company ethos and prepared for future challenges. The Business Development Bank of Canada (BDC) emphasizes the importance of a well-structured succession plan to the longevity and health of a business.

The Emotional Journey of Exiting

Exiting a business you've built from the ground up isn't just a financial event; it's a deeply personal one. Owners should be prepared for the emotional aspects of leaving behind a legacy and the shift in identity that can occur. Financial planning for life post-exit is crucial, but so is planning for personal fulfillment and growth.

Life After Exit: Planning for Personal and Financial Future

Envisioning Your Next Chapter: Crafting a Personal Blueprint

Once the hectic phase of handing over the reins comes to a close, what does life hold for the entrepreneurial spirit that's been driving the business forward? Many former business owners confront an unexpected void post-exit, not anticipating the importance of crafting a fulfilling personal and financial future. Planning should not halt at the exit door; it must extend into the rich tapestry of life's next act, ensuring the continuation of a purpose-driven journey. It's time to chart your life's new course with the same rigor you applied to your business strategies.

Financial Freedom or a New Set of Responsibilities?

While a successful exit often results in a substantial financial windfall, former owners need to be astute in managing their newfound wealth. The Exit Planning Institute underscores the significance of immediate financial planning to mitigate against the 'sudden wealth syndrome' which can lead to rapid asset depletion. Private equity veterans recommend a balanced portfolio that includes investment in business ventures well-aligned with the owner's expertise, alongside more traditional investments to ensure long-term stability.

Rediscovering Purpose Beyond the Boardroom

Creating a meaningful post-exit life can be as challenging as running a company. It's essential to identify a new passion that ignites the same fire as previous entrepreneurial pursuits. Business owner exit implies not only a business change but a lifestyle transformation. Studies suggest that staying engaged in some form of professional activity, whether through consulting or new business ventures, enhances life satisfaction after the exit. However, the chance to pursue personal interests, philanthropy, or public service can be equally rewarding.

Spotlight on Success: Case Studies and New Horizons

Learning from others can pave the way for a smooth transition. Look to successful entrepreneurs who have navigated post-exit life effectively. These include leaders who have shifted focus to mentor the next generation of entrepreneurs or invested in cause-related endeavors. A case study from the Harvard Business School highlights a business leader who, after exiting, channeled resources towards education reform. Their story reflects the broader trend of using entrepreneurial skills for societal benefit.

Building a Bridge to Your Future Self with a Robust Exit Plan

The business exit plan should not only list potential buyers or describe the types of exit strategies; it must include a personal roadmap for the owner. Incorporating personal goals and a vision for life post-business ensures that when the time for exit arrives, a robust, comprehensive strategy is in place. A thoughtful and well-articulated exit strategy plan that considers personal ambitions paves the way for a seamless switch between the professional peak and the personal pinnacle of success.

Consulting the Experts: Utilize Certification Programs

Exit planning doesn't have to be a solo journey. Leveraging certification programs, such as those offered by the Financial Modeling & Valuation Analyst (FMVA) or the Certified Exit Planning Advisor (CEPA) credential through the Exit Planning Institute, can offer structured guidance. These programs provide not only invaluable insights into the financial implications of exiting but crucially, also address the softer, more personal side of the transition.