Demystifying Corporate Finance: A Primer for Business Success

Understanding the Bedrock of Business Success

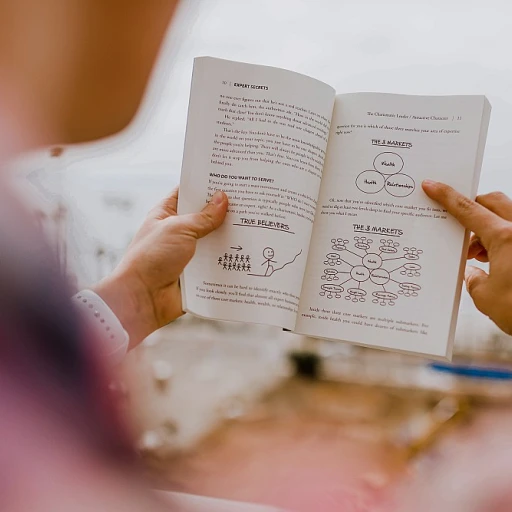

Corporate finance isn't just about crunching numbers and balancing spreadsheets; it’s the engine that propels business growth and supports strategic decision-making. With an emphasis on sustainable growth, this field is instrumental in plotting the long-term trajectory of a company. Expert insights from seasoned professionals like Ivo Welch, author of 'Corporate Finance,' suggest that a solid understanding of financial principles is key to navigating corporate growth and innovation.

The Role of Finance in Corporate Health

In dissecting the components of corporate finance, it becomes clear that it plays a critical role in assessing and maintaining the health of a business. Financial planning, capital budgeting, and ongoing financial analysis allow companies to chart their course and make calculated decisions. These skills are not just reserved for the CFO; they span the entire C-suite, influencing roles from treasury to capital management.

Finance as a Strategic Tool

Corporate finance goes beyond mere accounting, transforming into a strategic tool for company success. Through informed capital budgeting and astute investment decisions, businesses are able to unlock opportunities and foster innovation. Financial prowess, coupled with risk management, becomes a formidable ally in the CEO’s quest for market leadership. Recent reports indicate that applying financial data in a strategic context enhances a firm's ability to adapt to market changes and optimize cash flow.

A Foundation for Strategic Planning

United States enterprises acknowledge the weight of robust financial planning and analysis (FP&A). Industry leaders utilize advanced data analytics to inform their strategies, utilizing resources like discounted cash flow (DCF) and net present value (NPV) calculations to weigh potential initiatives. According to recent studies, companies that excel in financial analysis are more likely to pivot and scale in an ever-competitive global market, like those operating out of finance hubs in London and New York.

Finance and Firm Value

The ultimate goal of corporate finance is to maximize firm value, an objective that requires a medley of strategic acumen and financial analysis. For example, managing working capital can result in substantial improvements in both short-term functionality and long-term prosperity. Hence, techniques like cash flow analysis are critical, not only for the survival of a business but also for carving a sustainable path forward amidst challenging economic tides.

Balancing Act: Capital Structure and Company Valuation

Decoding the Capital Structure Conundrum

When it comes to corporate finance and company valuation, envisioning the perfect balance between debt and equity in a company's capital structure is akin to searching for the Holy Grail. A delicate equilibrium can propel a company towards sustainable growth, while a misstep can lead to financial disarray. Corporate finance professionals are often at the helm, steering this ship through turbulent capital markets.

Championing Smart Investment Decisions

Investment banking wizards, with their financial modeling prowess, wield discounted cash flow analyses to sketch out investment scenarios that coax the full potential from each dollar. These predictions don't just concern the long term; they're crafted to enhance working capital management with the precision of a maestro tuning a symphony orchestra. In the cacophony of market fluctuations, companies hinge on robust investments that promise to invigorate cash flow and elevate business vitality.

The Pulse of Valuation: Equity Meets Debt

Eyes often turn to capital markets for a glimpse into the latest strategies threading through Europe and London's financial districts. Here, the alchemy of capital structure transforms into a tangible measure of a company's mojo. The voices of CFOs across the United States resonate with a similar tune, emphasizing the value of a well-constructed capital foundation—blending debt and equity not just for the now, but for a future that's as unpredictable as the weather in London.

Case studies from the big leagues, like Google LLC, suggest that while debt can provide a tax shield, equity infuses the trust and freedom to explore long-term growth avenues. This intricate dance between the two reflects a company’s capacity to handle financial stress and bounce back from setbacks, bracing for both opportunities and the unforeseen gusts of risk that can sweep in without a moment's notice.

Financial Alchemy: Converting Risk into Reward

The term 'corporate finance' often brings to mind the nuanced art of risk management—the corporate equivalent of walking a tightrope. Financial planning and analysis experts tirelessly calibrate the scales, adding a pinch of debt here, or a cup of equity there, to keep the ship steady during a financial storm. It's a practice that balances analytical prowess with an almost precognitive sense of market movement, a skill honed over a solid career in corporate finance.

In navigating the complexities of capital structure, professionals lean on experiences, hard data, and sometimes a bit of intuition to orchestrate a plan that works. The tales of financial collapse when companies have gambled and lost serve as sobering reminders that every risk carries weight, and the goal is not to evade risk but to manage it with elegance and insight.

Ultimately, this part of our journey through the vistas of corporate finance underlines a simple truth: management's strategic choices in shaping capital structure directly influence a company's valuation. A thoughtful arrangement of financial elements can ensure the steadfastness of a business, enabling it to achieve its overarching strategic vision and ensuring the satisfaction of stakeholders in what can only be described as financial concert.

Beyond the Books: Cash Flow Analysis for Strategic Planning

The Lifeblood of Business: Mastering Cash Flow Management

Peeking behind the curtain of corporate success, you’ll find that cash flow isn’t just a chapter in financial textbooks; it’s the lifeblood that courses through the veins of businesses, keeping them lively and kicking. Cash flow analysis does more than just monitor the heart rate of a company’s finances; it equips leaders with the foresight to plan for the peaks and valleys of the business landscape.

Seasoned finance gurus often quip, “Revenue is vanity, profit is sanity, but cash is king.” This slogan finds its roots in a blueprint for success, an actionable strategy that goes beyond mere financial recording. Through rigorous cash flow analysis, companies can pinpoint operational inefficiencies that may bleed resources, track the ebb and flow of their financial health, and, ultimately, steer their strategic planning.

Stories in Numbers: What Cash Flow Reveals

Cash flow analysis, when deciphered right, tells elaborate stories. Positive cash flow narratives speak of a business that can sustain itself, pay debts, and invest in growth. Conversely, a tale of negative cash flow coins the image of a trapped company, gasping to keep its head above the financial depths despite apparent profitability. It’s a dance between the accounting ledgers and the strategic outlines of a business, with each step aiming for a harmonious routine that leads to a standing ovation from investors and stakeholders.

Gauging the Financial Pulse: Indicators and Metrics

Crucial cash flow indicators illuminate the path ahead. Eyeing the likes of Free Cash Flow (FCF), Operating Cash Flow (OCF), and Cash Flow from Financing (CFF) activities offers a panoramic view of where the money's coming and going. Investments in technology, product development, or market expansion are reflected in FCF. OCF sheds light on the efficacy of a company’s bread-and-butter operations, and CFF reveals how well a firm leverages debt and equity to fuel expansion.

Company brass often turn their gaze to the Discounted Cash Flow (DCF) technique, a valuation method that dispenses insight into a company's worth by estimating the value of its cash flows. Imagine complementing DCF with a sprinkle of risk assessment, such as sensitivity analysis, which dances around with the what-ifs of business scenarios. It waltzes through the potential outcomes of changes in sales volume, costs, and financing terms, guiding firms on how to best choreograph their financial future.

Forecasting with Finesse: Strategic Cash Flow Planning

Foresight mixed with financial acumen is the recipe for strategic cash flow planning. Companies implement forward-looking approaches, like rolling forecasts, to adjust their tune in real time, rather than being stuck playing the same old song. Layering short-term tactical movements with longer-term strategic visions leads to a composition worth an audience's full attention. It’s financial storytelling at its best, scripting a tale of sustainability, agility, and strategic triumph.

The sage advice of financial soothsayers—armed with charts and spreadsheets—often harks back to the fundamentals: understanding your operating cycle, nurturing working capital management, and seizing the moments when to throttle investment or rain in spending. It’s about setting the stage for business prosperity by syncing operational rhythms with financial flows.

Investing in the Future: Capital Budgeting Techniques That Pay Off

The Key Capital Budgeting Methods

When a company is ready to take a leap towards growth, understanding the nuances of capital budgeting is like owning a crystal ball. It’s the cornerstone of smart investment decisions that plants the seeds for a prosperous future. Common techniques include Net Present Value (NPV), Internal Rate of Return (IRR), and Payback Period calculations. These aren’t just mystical acronyms; they are real tools wielded by financial experts. For instance, NPV gives us a glimpse into the future by evaluating the profitability of an investment after accounting for the cost of capital. It’s an essential figure that often steers the ship when storms of uncertainty roll in.

Case Study Spotlights: Capital Budgeting Successes

Let’s talk real-life stories. Imagine a company standing before two roads - investing in a groundbreaking technology or upgrading their existing systems. A well-executed capital budgeting analysis can illuminate the path that maximizes shareholder value. Take Google LLC, with its sophisticated approach to data-driven decision-making. They’ve mastered the art of evaluating investments, ensuring each step forward aligns with their strategic vision and financial metrics. This isn’t just a practice; it’s a strategic narrative that outlines the company’s growth journey.

Integrating Risk Management Into Capital Budgeting

In corporate finance, predicting the weather isn’t enough; companies must also prepare for the tempest. Integrating risk management into capital budgeting is about foreseeing what could go wrong and mitigating those risks proactively. It involves scenarios where calculations of cash flows include variations to account for different economic climates, ensuring the grips on the financial tiller are firm and the company can navigate through both calm and choppy waters. This foresight is a testament to a company’s robust strategy and its determination to steer clear of being adrift in financial turmoil.

Staying Ahead of the Curve with Emerging Investment Strategies

As the corporate world evolves, so do the strategies for capital investment. Innovative techniques like ESG (Environmental, Social, and Governance) criteria promote investments that are not only profitable but also responsible. There’s increased recognition that financial gain can coexist with positive impact, a trend that’s quickly becoming a clarion call for investors and companies alike. Staying ahead of the curve is about recognizing these shifts and incorporating them into the investment analysis. Only by doing so can companies ensure they’re making decisions that pay dividends in both the financial ledger and the ledger of social responsibility.

Committing to Continuous Learning and Adaptation

The realm of corporate finance is no static battlefield; it’s a terrain that’s perpetually reshaped by market forces, technological advancements, and regulatory changes. Professionals in this field, therefore, adopt a stance of lifelong learning. Certifications such as CFA (Chartered Financial Analyst) and FMVA (Financial Modeling Valuation Analyst) represent just a fraction of the learning avenues available. These certifications aren’t merely titles; they are badges of commitment to excellence and adaptation in the intricate dance of corporate finance.

The Spectrum of Risk: Managing Uncertainty in Corporate Finance

Identifying Trends: The New Quality of Risk Management

Corporate finance, with its focus on balancing risk and reward, is at the core of strategic business management. In our journey through capital and cash flow discussions, we recognize that the heartbeat of finance thrives on the pulse of risk management. Financial experts have chronicled the evolution of risk from a mere afterthought to a front-and-center concern in strategic planning. According to Ivo Welch, a notable author in the space, modern corporate finance professionals are equipping businesses with the tools to understand, quantify, and navigate through risk.

Quantifying Risk: Models That Bring Clarity

Complex risk modeling, including techniques like discounted cash flow (DCF) and sensitivity analysis, has become the standard in corporate finance. These models allow companies to predict future cash flows and assess variability in outcomes. Financial management teams leverage sophisticated statistical software, sometimes even using structured query language (SQL) for data management and analysis. As such, an adeptness in financial modeling is now a fundamental skill in a corporate finance career.

Globalization and Risk Dynamics

Business landscapes continue to expand, just as capital markets in London, New York, and across Europe become more interconnected. With global reach comes a broader spectrum of risks — from currency fluctuations to geopolitical upheaval. Corporate finance has thus evolved to mitigate such risks, through strategies including diversification and hedging. Studies suggest that a robust risk management strategy can be a significant competitive advantage in this interconnected world.

Corporate Strategies in Risk Mitigation

With capital at stake, companies are increasingly employing risk management in capital budgeting and capital structure decisions. Whether it’s evaluating long-term investments or analyzing debt and equity options, understanding and managing risk is paramount. Industry case studies reveal that successful risk management goes beyond financial planning & analysis (FP&A), influencing all aspects of corporate strategy.

Regulation and Risk

One cannot overlook the role of regulations and compliance in shaping risk management protocols. Controversies like high-profile corporate collapses have led to tighter regulations. Corporate finance professionals now regularly engage with legal and compliance teams to navigate the complexities of financial regulations and avoid the substantial risks associated with non-compliance.

Emerging Risks and ESG Considerations

Today, Environmental, Social, and Governance (ESG) factors form a new frontier in corporate risk management. Companies are recognizing that sustainability and ethical practices are not just altruistic goals but vital for long-term success. Incorporating ESG considerations into risk frameworks is an example of how financial strategies adapt to societal values and expectations.

Evolving Horizons: Trends in Corporate Finance That Are Reshaping Industries

Shaping the Future: Corporate Finance in the Era of Innovation

The transformative impact of recent trends on corporate finance cannot be understated. Company strategists and finance professionals alike are witnessing a reshaping of industries, propelled by the deliberate integration of tech advancements and financial acumen. These trends underscore the necessity for a savvy grasp of corporate finance, to propel businesses toward not just survival, but thriving innovation.

Green Financing: Sustainable Investment's Rise

In the realm of corporate finance, the surge of Environmental, Social, and Governance (ESG) criteria stands out, with companies increasingly judged on their sustainability and ethical impacts. The data underscores this shift: according to the Global Sustainable Investment Alliance, sustainable investment assets reached $30.7 trillion at the start of 2018, a 34% increase in two years. This trend reshapes corporate finance by necessitating a greater evaluation of long-term risk and return, factoring in the externalities of business operations.

Technology's Pivotal Role in Finance

Staying ahead of the curve, corporate finance professionals are leveraging technology such as Business Intelligence (BI) tools and Structured Query Language (SQL) for more data-driven decision-making. A report by McKinsey Global Institute suggests that data-driven organizations are 23 times more likely to outperform competitors in customer acquisition and 19 times more likely to be profitable. This reliance on big data and analytics signifies a major trend in remapping corporate finance strategies towards a more empirical and agile approach.

Digital Currencies and Decentralized Finance

The introduction of digital currencies and decentralized finance protocols is also posing intriguing possibilities for corporate treasuries. According to a report by Deloitte, around 36% of organizations surveyed are considering or already using cryptocurrencies in their operations. This adoption reflects a broader understanding within corporate finance that diversification and embracing new forms of liquidity can be beneficial in managing company assets.

Agility in the Face of Uncertainty

Corporate finance has always grappled with uncertainty, but the floating landscape of global economics calls for even sharper risk management tactics. Consider the insights from Ivo Welch, a finance professor at UCLA, whose work emphasizes the importance of maintaining flexibility within capital structures to adapt to sudden market shifts. Welch's analysis promotes an agile approach to corporate finance, validating strategies that leave room for manoeuvre in response to global economic changes.

Incorporating AI and Machine Learning

The merger of artificial intelligence (AI) and machine learning into financial modeling has empowered companies to simulate and predict various financial scenarios with greater accuracy. This evolution is dramatically changing the corporate finance landscape, as reported by the CFA Institute, which has begun to incorporate AI education into its certification programs, acknowledging the transformation AI brings to the finance industry.

Conclusion: Corporate Finance as a Strategic Partner

The metamorphosis of corporate finance is well underway, with each emerging trend carving a new path for professionals. From the environmentally conscious investment surge to the high-tech augmentation of financial analysis, corporate finance is no longer a backstage player but a leading co-navigating force in strategic business evolution. As these trends continue to unfold, corporate finance is set on an uncharted course, crafting the very future of industry and commerce.

The Financial Maestro: How CFOs Craft Strategy with Corporate Finance

Orchestrating Financial Strategy: The Role of the CFO

In the symphony of corporate growth, Chief Financial Officers (CFOs) are the maestros making strategic decisions that harmonize financial performance with long-term business objectives. At the intersection of finance and strategy, these leaders not only navigate complex regulatory waters but also project the future through smart capital allocation. The core of a CFO's role is to ensure that a company's financial structure and strategy are robust enough to withstand market fluctuations while positioning it for sustainable growth.

Realizing Vision with Financial Foresight

The modern CFO brings more than just a knack for numbers to the table; they are visionaries who, with a thorough understanding of market trends and corporate finance, craft strategies that propel the company forward. By delving into financial modeling and forecasting, CFOs are able to predict cash flows and manage the delicate balancing act between investments, debt, and equity. Ivo Welch, a noted expert in the field, emphasizes in his book on corporate finance the importance of a solid grasp of economic principles for making informed financial decisions.

Tackling Capital Challenges Head-On

Strategic financial management involves more than just number-crunching; it's about identifying opportunities to optimize the cost of capital and understanding the ideal capital structure for the company's context. Reports from leading financial institutions highlight the changing dynamics of capital financing and challenges related to capital budgeting. CFOs often turn to such insights to formulate strategies that take into account ESG factors, ensuring financial decisions are also socially responsible.

Risk Management as a Strategic Edge

Another critical area where CFOs add strategic value is in risk management. This goes beyond protecting assets to foreseeing potential threats and opportunities in the company's external environment. With expertise in financial analysis and risk management, corporate finance professionals anticipate market shifts and guide the business away from financial pitfalls. This forward-looking approach strengthens the company's resilience and adaptability in an unpredictable corporate landscape.

Financial Leadership and Corporate Vision

Leading with financial acumen, CFOs collaborate with other C-suite executives to ensure that financial planning aligns with corporate strategy. It's not just about short-term gains; it's about setting and achieving long-term goals. As the chief financial officer, they have their finger on the pulse of all financial aspects within the company, from working capital management to mergers and acquisitions. Their deep understanding of financial modeling and valuation is crucial for evaluating strategic initiatives and guiding the company towards a prosperous future.

Forging Paths in Finance: Career Opportunities and Development in Corporate Finance

Empowering Your Corporate Finance Journey: Opportunities for Growth and Advancement

The realm of corporate finance is not just about crunching numbers or steering companies through the ebb and flow of markets; it's a career landscape ripe with opportunities for professional evolution and impact. The right blend of skills, passion, and knowledge can ignite a career trajectory that is both fulfilling and dynamic. But what does it take to navigate this path, and how can one capitalize on the burgeoning career opportunities in corporate finance?

The Bedrock of Corporate Finance Careers: Nurturing Your Skill Set

From risk assessment to strategic investment decisions, the core competencies required in corporate finance are both vast and nuanced. Financial modeling and valuation stand as towering skills in the toolset of any professional in this domain. A clear understanding of concepts such as discounted cash flow (DCF) and internal rate of return (IRR) is indispensable. Upskilling through certification programs such as the CFA or FMVA can provide a deep well of knowledge and a competitive edge in the job market.

Stepping Stones of Success: From Financial Planning to Chief Financial Officer

Within corporate finance, each role acts as a building block to the next. Junior analysts who cut their teeth on spreadsheets and cash flow analysis often evolve into roles that require strategic oversight. Financial planning & analysis (FP&A) experts, for instance, not only forecast future revenues and expenses but also shape the strategic direction of their business units. As professionals climb the ladder, roles such as treasury and the coveted position of the Chief Financial Officer (CFO) become within reach. The CFO's role, in particular, is pivotal – a blend of leadership, strategic foresight, and financial expertise that drives a company's success.

Cultivating a Global Perspective: Corporate Finance on the International Stage

Corporate finance is a global game. Whether it's navigating capital markets in London and Europe, or mastering the intricacies of mergers and acquisitions, international exposure can exponentially increase one's value as a corporate finance professional. Combining technical finance skills with an appreciation of global economic trends and regulations prepares professionals for opportunities in multinational corporations or even cross-border consultancy.

Joining the Vanguard of Innovation: Corporate Finance and ESG

The landscape is witnessing a shift where traditional finance roles intertwine with advancing fields such as environmental, social, and governance (ESG) considerations. Corporate finance is at the front line of translating ESG values into tangible financial strategies. This is not only an area of immense growth but also one where professionals can contribute to a sustainable future while meeting investor and stakeholder expectations.

The Road Less Travelled: Alternative Careers in Corporate Finance

Not all who wander are lost, especially in the flexible world of corporate finance. Those drawn to academia may find themselves following in the footsteps of thought leaders like Ivo Welch, breaking new ground with research that shapes corporate finance philosophy. Or, for those who revel in the art of the deal, a career in investment banking or venture capital offers a high-octane path driven by analysis and negotiation.

A Lifelong Quest for Knowledge: Continuous Learning and Development

Finally, the key to thriving in corporate finance is recognizing it as a journey of perpetual learning. The sector's continuous evolution demands a commitment to ongoing education, be it through formal degrees, professional certifications, or practical experience. In this dynamic environment, staying abreast of new tools, technologies – such as business intelligence data analytics and query language SQL – and financial innovation is paramount to maintaining relevance and advancing one's career.

In corporate finance, the potentials are as numerous as the risks are calculable. From the adrenaline rush of trading floors to the structured thoughtfulness of long-term financial planning, a career in corporate finance is a testament to the power of strategic financial management in shaping the fortunes of businesses large and small. To those embarking on this career path – be it through financial analysis, management, or innovation – the future is as promising as the strategies you're poised to develop.

-large-teaser.webp)